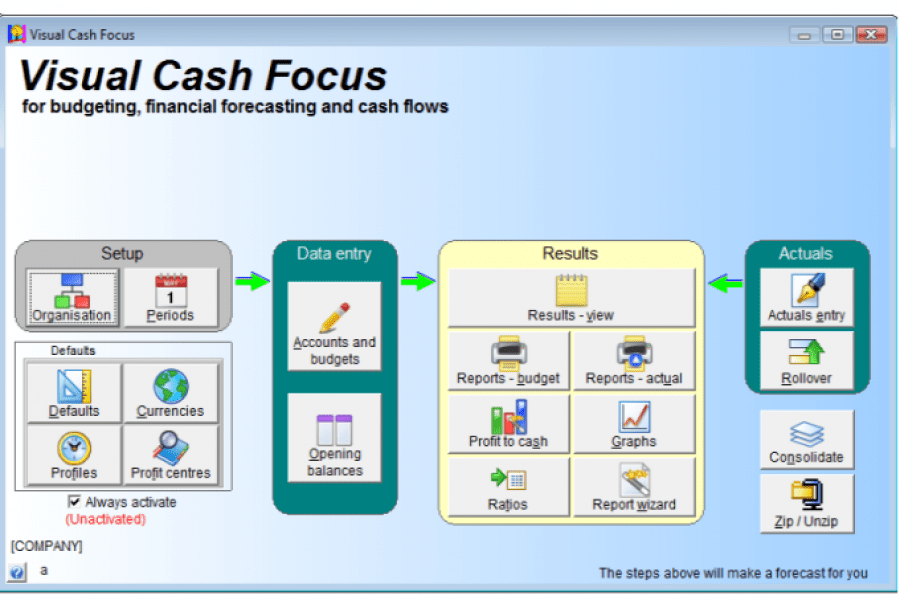

Central Navigation Map

The budgeting forecasting software map above is the central hub of Visual Cash Focus and guides you through the budget process.

The map shows the steps needed to prepare or review a budget or forecast. There are four main steps to preparation. Starting from the left of the map, these are 1: Setup, 2: Data entry, 3: Results and 4: Actuals.

In Setup the duration of the budget and cash flow forecasting are established. Visual Cash Focus produces a rolling forecast significantly reducing month end reporting chores. Departmental budgets are handy where individual profit center data is necessary

On the left there is also a Defaults block, and on the right are buttons to Consolidate budgets / forecasts; and Zip / Unzip files. The key drivers and activity assumptions are part of defaults. Facilities exist for a budget with multi-currency revenue and expenses and currency conversions. Cash flow profiles determine when and how the funds will be accounted for. Money can be allocated to more than one bank or asset account. The time frame over which a creditor account will be paid can be specified.

Defaults contain your general budget rules. Data entry manages individual line items and here you can override defaults if necessary. Once the data is entered the software produces the Income Statement/ Profit and Loss, Balance Sheet and Cash Flow Statement. Budget tracking of results is facilitated with a conventional double-entry accounting Debit/Credit drill down facility into the budget.

The central map from which everything starts makes finding your way around easy. Whilst the need for an excel budget template is eliminated, for those who like Excel integration to Excel from Visual Cash Focus is built into this budgeting tool. The system enables accounts to be integrated on a line by line basis so that the data transfer, comparison and accuracy of actual and budget data is assured.