What is Rolling Forecast?

Budgeting and forecasting with rolling forecast maintains a constant number of periods in the projection.

Forecasting like budgeting involves future projections. Traditionally businesses look at a static period for example 1 year ahead. If the financial year is July to June then budgets and forecasts are prepared well in advance to cover that period. By October, 3 months of trading has already taken place leaving only 9 months remaining of the forecast. With static forecasts you run the periods down to zero and then start again.

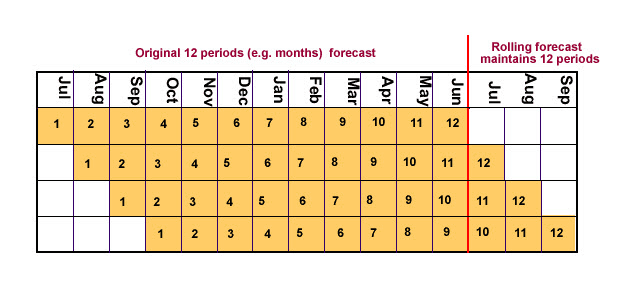

With a rolling forecast the number of periods in the forecast remain constant so that if for example the periods of your forecast are monthly for 12 months then as each month is traded it drops out of the forecast and another month is added onto the end of the forecast so you are always forecasting 12 monthly periods out into the future.

The number of periods in a rolling forecast remains constant e.g. the original forecast if for 12 periods and the period length is monthly from July to June.

As actual trading amounts become available for a period it moves from being a future prediction to a current reality i.e. it is no longer part of the forecast so it drops out of the forecast and another month is added onto the end of the forecast (you roll the forecast forward one month) so you are always forecasting 12 months out into the future.

Benefits of rolling forecast.

In the modern world business conditions are volatile and change rapidly. There is little future for a business not in a position to respond quickly to external market changes so flexible planning processes are vital to rise to the challenge. This is where the effectiveness of rolling forecasts in the planning process are most keenly felt. With rolling forecasts you keep a finger on the pulse of changing conditions and can quickly refocus the business accordingly e.g. decisions on which projects to scrap and which to invest in can be made timeously.

Obviously the speed and accuracy of your financial forecasting will have a bearing on the profit of the organization. These factors can be enhanced by using the correct tool for the job. Like budgeting there are basically two approaches for rolling forecasts. You can either use a spreadsheet or some spreadsheet based solution with all its inherent risks and defects, or you can use dedicated solution like Visual Cash Focus budgeting and forecasting software. The huge advantage of a dedicated solution lies in the fact that it is not human resource reliant. Anyone who has been left to pick up the pieces of a spreadsheet started by someone else will be all to familiar with the perils inherent in trying to unravel the “masterpiece” of a colleague no longer available for consultation. Also financial specialists generally have very different skill sets from those necessary for complex spreadsheet programming and its not the best use of their skills to waste time doing something outside their specialized skill set.

Annual budget rounds are resource intensive in time and money, need to be prepared well in advance of the planning periods under review and are often outdated from changing market conditions pretty early on in the time frame. With Visual Cash Focus the last period of the forecast is rolled forward as the basis for new period so the managers are always reviewing the most up to date predictions for the rolling forecasts. If your forecast periods are monthly and you roll the forecast 12 times then the following years forecast is complete without the need for another budget round so a rolling forecast can eliminate the annual budget process.

Probably the most important beneficiary of a good rolling forecast is having an accurate handle on likely future cash flows in the business. No longer is the income statement a sufficient measure of viability or being able to turn to banks for funding cash shortfalls a certainty. Since the global financial crisis bank credit is in very short supply and unless the business has its own cash reserves the road ahead is far from secure.

Return to Visual Cash Focus overview