Activity based costing costs

Many costs are general in nature. The cost allocation software distributes these expenses proportionately either directly or indirectly to the Cost Objects which produce the income

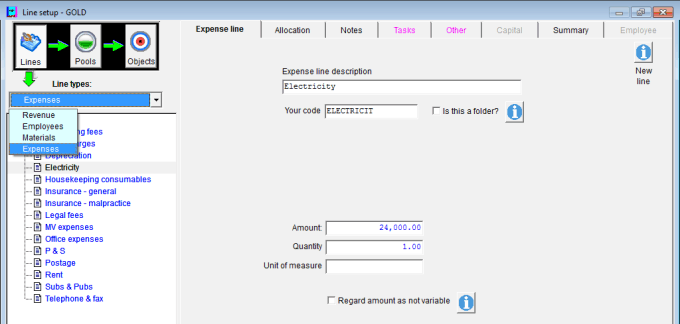

For example a business has Expenses like accounting fees, bank charges, electricity, rent etc which are not product or service dependent. The same applies to Employees and Materials. Often employee time is spent on a range of activities all of which contribute to multiple revenue sources. Similarly many materials will be used in a range of income producing products or services. These types of costs need to be distributed proportionally among all the beneficiaries.

Sometimes Cost lines can be allocated directly to Cost Objects but often the sharing of such expenses occurs via a range of intermediary entities known as cost pools.

ABC Focus facilitates this process enabling Cost lines to be allocated to Tertiary pools, Secondary pools, Primary pools and / or Cost objects

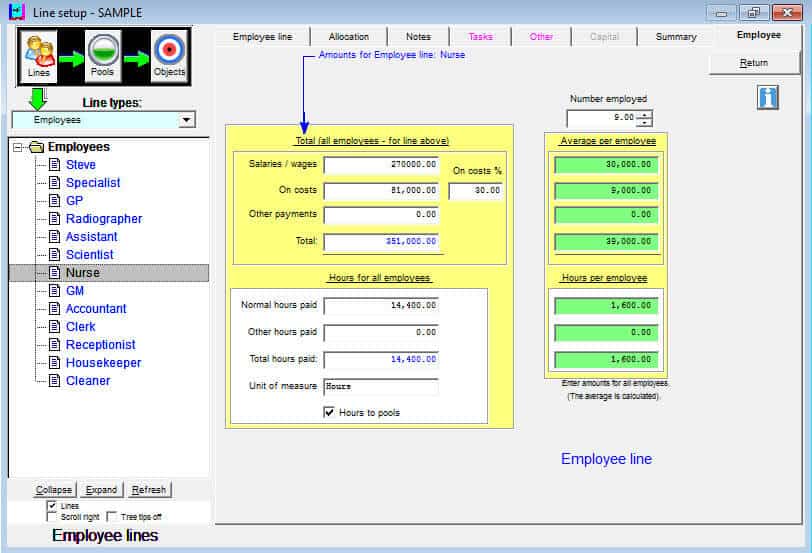

Employee cost lines

The employees are handled per category. In this case its a medical practice that employs staff for various functions like nurses cleaners etc. Workers are grouped according to function as are associated wages and salary costs, hours worked etc.

The Cost lines input forms are changeable via the drop down menu to any of the 4 cost line types (Revenue, Expenses, Employees, Materials).