Tour of Visual Cash Focus

VISUAL CASH FOCUS

Visual Cash Focus offers extensive flexibility in data handling to produce budgets forecasts and cash flow predictions. eg:

- Ability to budget by department or profit centre.

- Multiple currency budgets

- Budget using non financial drivers

- Flexible budget periods

- Multi level chart of accounts

- Flexible cash flow assumptions. Linking revenue and expenses to specific balance sheet accounts

- User Journals

- Interface with Excel

- Budget for manufactured items

Lets begin creating a budget.

Create the budget

Departmental budgets

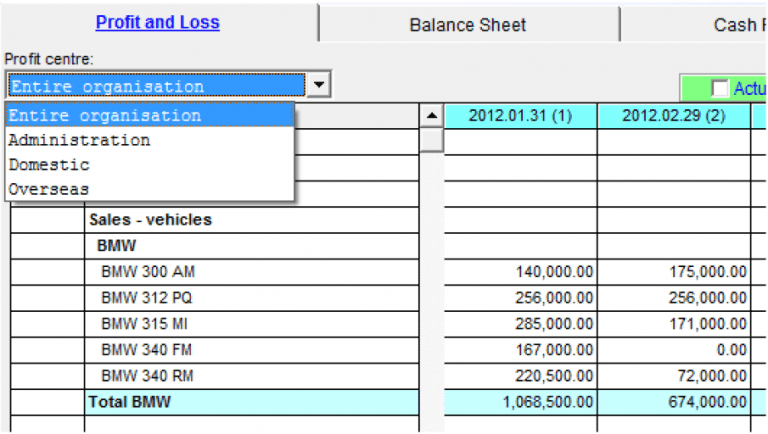

Visual Cash Focus has strong capabilities for producing budgets and cash flow forecasts per profit center / department

A profit center is essentially any entity which forms part of a greater unit but for which budgets and cash flow forecasts are required both individually and as part of the unit, for instance different branches of a national retail outlet or departments within a company etc.

Any number of departmental (profit centers) budgets are catered for. Each profit center manager can enter their own budgets. Reports include the profit & loss/income statement and cash flows per profit center, per group of profit centers or for the enterprise. You can determine profitability and cash flow forecast for the whole organization or per profit center. Profit centers otherwise known as departmental budgets extend the capabilities of your budget model considerably for very little effort.

When to use departmental budgets

Budget preparation involving multiple departments or profit centers can occur in either of two ways depending on the outcome required and determined by how data is input. Independent entities can each be prepared as a separate budget model followed by budget consolidation of all of the models. Alternatively consolidated the whole company can be included in a single budget sub-divided into profit centers. The determining factor between which method to use is the Balance Sheet. If you want the whole organisation to share a common Balance Sheet then use departmental budgets.

Multi currency budgets

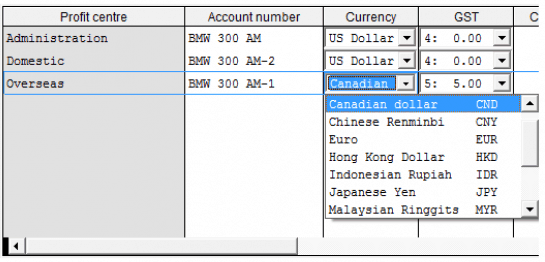

Data for budgets and cash flow forecasts can be input in any currency. Budget currency conversion from multiple currency inputs is streamlined.

Budget currency conversion capabilities

In all versions except the entry level “Standard” edition all budgeting and forecasting can have multiple currencies with both fixed and variable foreign exchange rates.

With the Corporate and Enterprise Editions multiple currencies are available for Actuals also.

In a budget model, accounts can be entered in any currency but results are shown in the HOME currency. Each currency can have a Fixed exchange rate or multiple Variable exchange rates to cover different date ranges. You can use variable rates for selected forecast periods. All foreign currency exchange rates are shown relative to the fixed rate of the home currency.

For international operations Visual Cash Focus budget software simplifies evaluating foreign currency scenarios and tracking foreign currency commitments.

Budgeting non financial quantities

Sometimes one needs to budget non financial items as these are drivers of financial outcomes and are therefore integral to budget and cash flow forecasts. With Visual Cash Focus the inclusion of non financial budget quantities is simple.

In all versions except the entry level “Standard” edition all budgeting and forecasting can contain both financial and non financial items.

Why budget non financial items?

Sometimes you wish to budget an account on some non-financial driver or measure. Examples: number of hotel rooms, tones of coal, number of clients serviced etc. These non-financial quantities do not appear on the financial reports, but can be used to calculate the budgets as they are drivers linking planned activities to financial results. For instance in a service industry type business the number of clients serviced could be the factor determining financial viability as a going concern. “What-is” scenarios with these drivers and resultant budget with cash flow forecasting can indicate requirements for breakeven and profitability. This provides additional flexibility for entering budget data.

Flexible budget periods

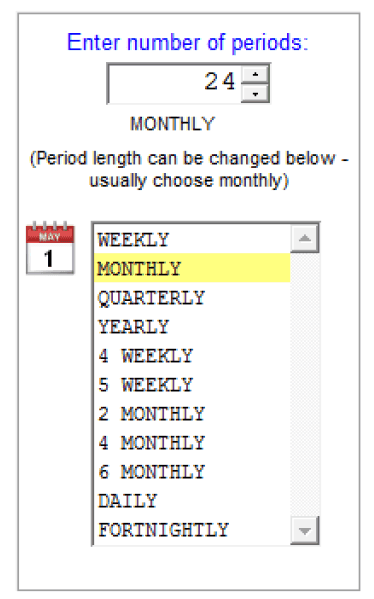

Budgeting and Forecasting with a flexible budget period is core to Visual Cash Focus budget software.

You can have one or several years in the same budget model. Budget periods are flexible – monthly, daily, weekly, fortnightly, quarterly and annual as preferred.

Generally you add 3 extra periods beyond the required budgeting periods. So a twelve month forecast should have 15 periods. A 36 month forecast should have 39 periods. This is to take into account any “End effects”. Example: Sales in month 13 may require the purchase of inventory in month 12 or 11 and this will affect the inventory levels, creditors and bank on the balance sheet for this year. Three months is sufficient to cater for most organization’s “end effects”, but if you have long Lead times (e.g. farmer producing wine) you can increase the number of periods to forecast.

Chart of accounts

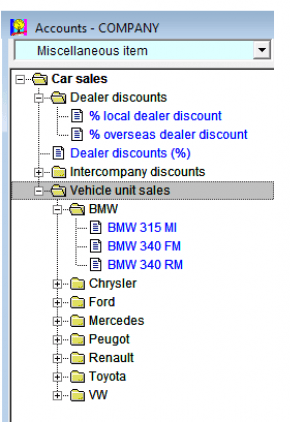

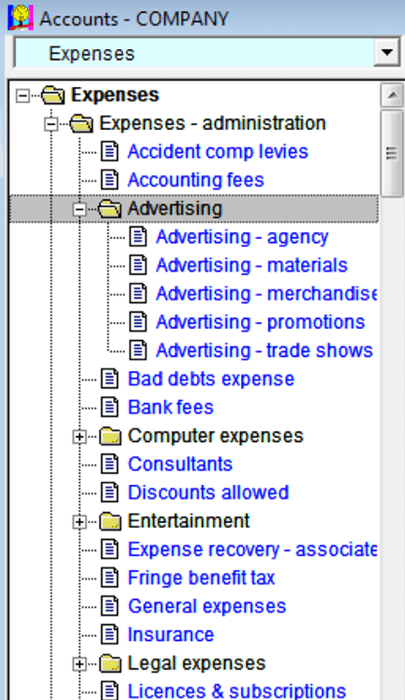

Visual Cash Focus supports multiple account levels in budget Chart of Accounts for budgets and cash flow forecasts.

The chart of accounts is displayed in tree format consisting of folders and sub-folders. Your chart of accounts can have multiple levels i.e. you can have sub-accounts of sub-accounts of sub-accounts etc. This is very handy for totaling and sub-totaling accounts.

For best results the budget chart of accounts should mirror that used with your ledger system. this will facilitate line by line account data transfers and the comparison of actual data with that of the budget or forecast.

Cash Flow profiles (assumptions)

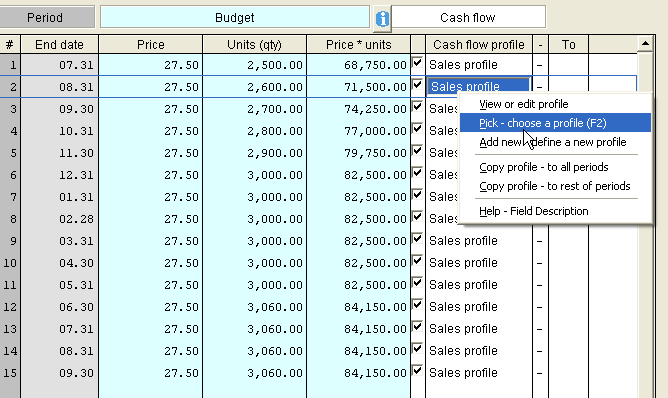

Cash flow assumptions are integral to budgets and cash flow forecasts. Many budget amounts impact upon the bank account. Revenue from sales must be collected over time and expenses are often paid one or more months in arrears. In Visual Cash Focus these assumptions are known as profiles.

Future cash flows are calculated by reviewing when cash is collected or disbursed (inputs and outputs). Amounts can be accrued until cash is received or paid. An account’s cash flow profile describes these timing schedules based on the cash flow assumption as well as the accounts associated with the cash flow.

With Visual Cash Focus an account can have a different cash flow profile for every period in the budget.

This ability to assign a “cash flow profile” per period is very handy when catering for seasonality, changing trade terms, sales etc. Enabling account cash flow assumptions to vary by budget period for the duration of the rolling forecast should facilitate greater accuracy between actuals and forecast over time.

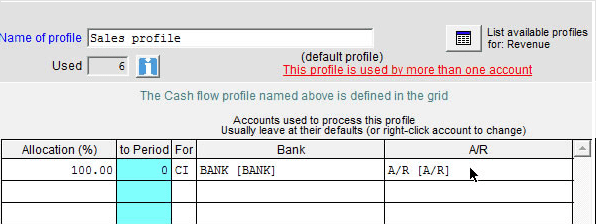

Link revenues and expenses to specific balance sheet accounts

In profiles revenues and expenses can be linked to specific balance sheet accounts, e.g. revenue can be linked to accounts receivable and bank accounts or inter-company accounts.

E.g. in the cash profile here 100% of the cash goes to the designated bank account. However if you wanted the proceeds to go to more than one bank account just set the cash profile up accordingly.

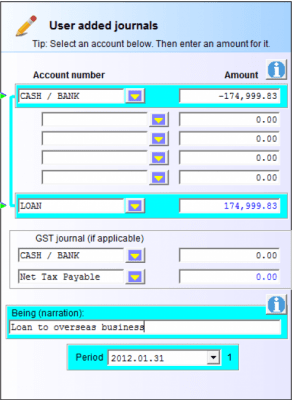

User journals

User Journals are accounting journal entries in Visual Cash Focus that add flexibility to the budgeting and cash flow forecasting system.

These user journals extend the capabilities of the budget (if required).

Visual Cash Focus takes the data you supplied for the Sales budget, Expense budget etc and generates journals. You can supply additional journals for any account. These journals will be brought in at the appropriate period. Thus if the journal you have added affects BANK then all consequences affecting BANK (such a interest charged) will be taken into account when appropriate. This gives you ultimate flexibility in that almost any accounting transaction can be duplicated by the use of these user added journals.

Interface with Excel

Software with a budget excel interface facilitates the use of Excel where and if necessary without many of the disadvantages inherent in spreadsheets budgets

When a budget excel interface is useful

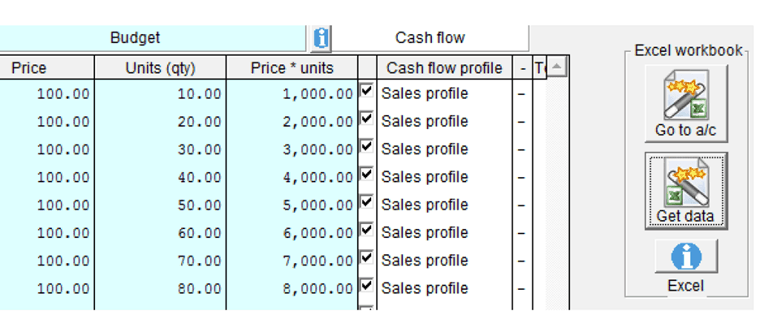

Usually one types the amounts directly into the budget per period in Visual Cash Focus. However, there may be times when you want to derive amounts from calculations you’d like to do in Excel. Should the desire arise its extremely simple to link the budget of an account to an Excel spreadsheet for the calculations and then import the results back into the Visual Cash Focus budget per period for that account.

Button clicks allow you to toggle between the two applications. One takes you directly to the relevant existing spreadsheet entry or creates one with the appropriate template to the account you are on e.g. if the budget is Price per unit, it creates the appropriate Price and Unit columns in the spreadsheet. The other automatically deposits the relevant data into its correct place in the budget.

If you are an avid Excel fan but need the advantages of non spreadsheet based budgeting and forecasting with Visual Cash Focus you have the best of both worlds with the spreadsheet as supporting schedules to the budgeting forecasting software.

Manufactured items

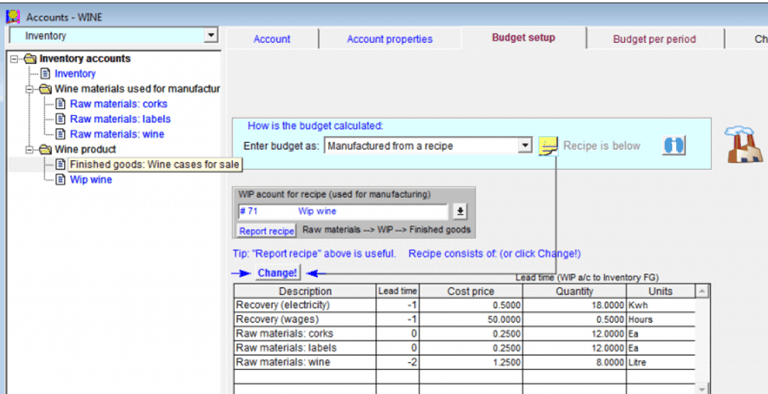

Manufacturing budgets are necessity if your operation involves the assembly or manufacture of products from raw materials or where the cost of sales include things other than finished goods. Visual Cash Focus includes inventory management methodology to facilitate budget manufacturing for those who need budgets and cash flow forecasts involving work in progress.

With budgeting and forecasting software for manufacturing, functionality for the ability to recover and capitalize overhead expenses in the manufacture of finished goods is necessary. Budget manufacturing is a niche requirement available in Visual Cash Focus from the Corporate edition upwards. With budget manufacturing you can calculate a “bill of materials” and manage raw materials, WIP and finished goods levels for any number of product lines.

Budget manufactured items

In a normal business, cost of sales (COS) consists of sales of goods already in stock or purchased. For a manufacturer, COS also consists of items manufactured from raw materials and other resources like electricity, wages etc.

Compare Actual data to forecasts

Rolling forecasts

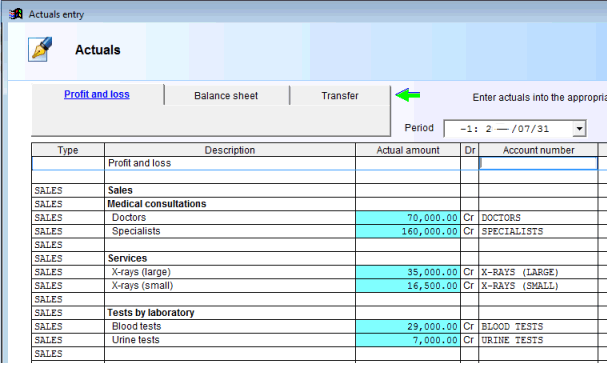

With a rolling forecast when a forecast period gets actual data that period moves out of the forecast and another period is added to the end of the forecast leaving the total number of periods in your forecast unchanged.

You can enter Actuals for each period and use the software management performance reports to monitor actuals versus budget and forecast. See how actual trading compared to the budget and forecast for the period.

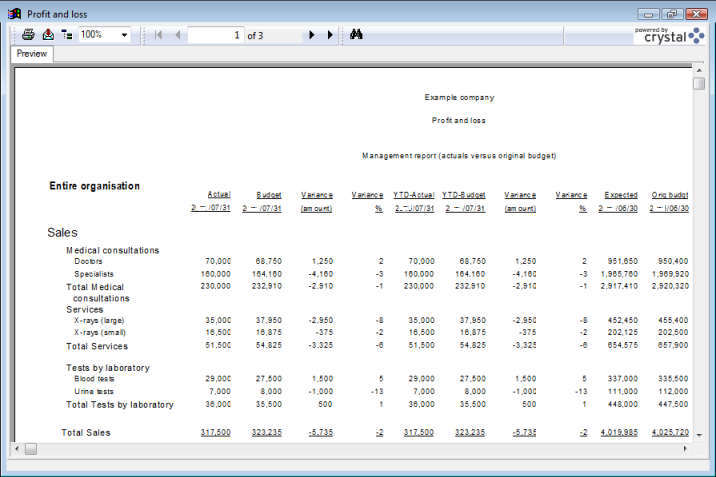

Report actuals vs budget with variances.

Compare actuals to current, year-to-date and full year budget and report variances.

Reports include actuals versus budget, variance as an amount and percentage and calculation of expected outcome based on the actuals to-date.

The software also calculates the cash flow from the balance sheet and profit and loss for the budget as well as actuals so the built in rolling forecasts include “actual cash flows”.

Rolling forecast benefits

Rolling forecasts in Visual Cash Focus budget software eliminates the annual budget process and transforms month end reporting from a laborious manual chore to quick and easy automated task.

When Actuals are entered the forecast automatically extends one period copying the data from the last forecast period. This data is then reviewed by management and adjusted accordingly. If you’re rolling monthly, after 12 times the forecast is already extended by a year and a comprehensive review of the data has already occurred and there is no need for another budget round.

Integration with Xero

Xero and other accounting packages store the historical data (financial transactions that have already occurred) of the business (“Actuals”).

Visual Cash Focus (budget and forecasting software) forecasts the budget for a business or entity. It organises the financial transactions that are expected to occur over the next year (or more). It also reports actual performance versus the budget.

As shown in diagram above Xero and Visual Cash Focus combine to give you a full picture of your business.

Xero can be interrogated and asked to supply its Actual data to Visual Cash Focus which means that if you are using Xero for accounting you can auto transfer Actuals directly into Visual Cash Focus

See the results

Consolidation of budgets

Budget consolidation is the process of combining one or more budget models into one model for reporting purposes.

In all versions of Visual cash Focus budget software except the entry level “Small business/ Standard” edition consolidation of models is included. Budget consolidation is automatic.

Any number of models can be consolidated. The models should be of the same duration.

Consolidation is done at the account level. If the account numbers match they are consolidated. If an account occurs in only one forecast it also appears in the consolidated model. Automatic eliminations between models during consolidation comes with the Corporate and Enterprise editions.

Budget consolidation vs Departmental budgets

If you are budgeting and forecasting for multiple separate entities, like different companies, each with their own balance sheet then each entity needs its own model. Consolidation of budgets will convert these models into a single budget model. However if the entities are for instance different departments within the same company and share a common balance sheet then a departmental budget model is all that is required.

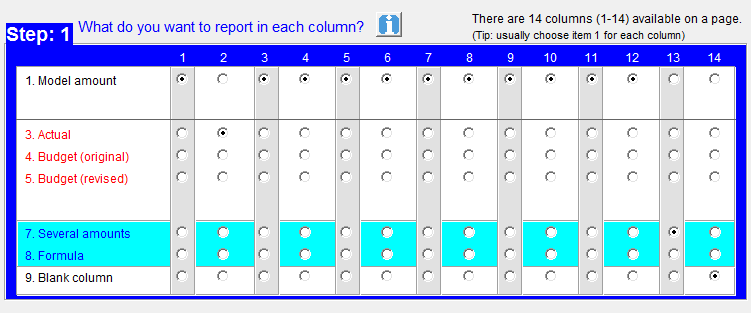

Report wizard

For all except the basic “Small Business” edition a report wizard provides for customization of reports. The report wizard is also handy to report from more than one model simultaneously.

The report wizard is simply a page layout mechanism. There are 14 columns available on a page, and you can specify what you want in each column. This can be an amount from a model, a calculated amount or a formula. You have a lot of flexibility. Most of the time the standard reports built into the system will satisfy your reporting needs, buy when you need a specific format the report wizard is useful.

Budget analysis audit trails

Traditional double entry budget analysis audit trails are a key feature of Visual Cash Focus. Any amount in a budget or cash flow forecast has a debit/credit drill down facility for budget tracking the result to ensure its integrity.

Audit trail and key timing assumptions report are available for easy model review. It uses proven double-entry forecasting methods to bring you unsurpassed budget forecasting accuracy and audit trail checking.

Double entry budget analysis ensures accuracy

Visual Cash Focus prepares the budget like the traditional accounting ledger. For every transaction a genuine double entry occurs in the ledger so tracing transactions and pinpointing discrepancies is achieved in exactly the same way as presently occurs for historical financial analysis. This budgeting forecasting software does not rely on anything other than traditional double entry accounting to produce the budgets making it familiar territory for anyone with an accounting background.

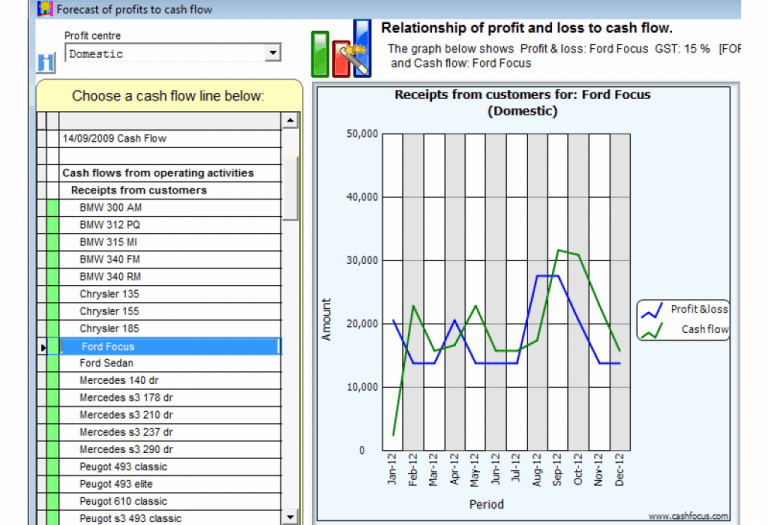

Profit vs cash flow report

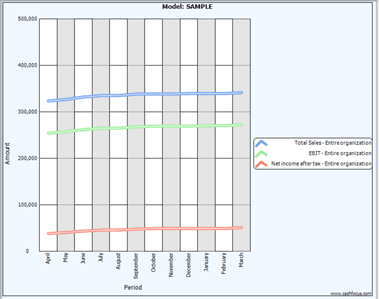

Profit vs cash flow looks at the relationship between the profit and cash flows in your business. This is a graphically presented report.

Why the need for profit vs cash flow report

See instantly how long it takes for profits to be converted into cash flow. Visual Cash Focus will forecast profits and the corresponding cash flows.The graph shows the profit and loss amounts that contribute to cash flow, i.e. the relationship of profits to cash flow.

Example: When an item is sold, it will appear on the profit and loss or income statement. If your customers don’t pay straight away, the cash flow corresponding to the profit line will be delayed. This module shows the relationship between profit and cash flow.

An interesting graph is the total net cash flow for the organization as a whole. It shows the profit & loss for each period versus the corresponding cash flow for the business.

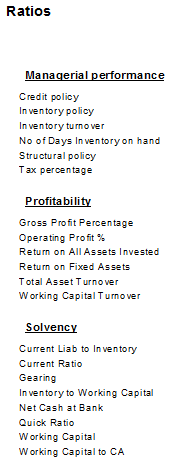

Budget performance measures

Budget performance measures include both standard and user defined ratios.

Flexible budget performance measure ratios

User defined ratios extend the capabilities for measuring budget performance. Visual Cash Focus contains many standard ratios. You can change the definitions of existing ratios and add any additional user-defined ratios desired. There is a formula builder to facilitate the process. Formulas can contain accounts and predetermined subtotals. Ratios can be based on budgeted, forecast or actual amounts.

The software also includes sensitivity and “what-if” analysis. One can examine the effect of price, direct costs and expenses on the forecast. See the impact of changes on profitability and cash flow.

Graphs

Graphs in budgets facilitate the analysis of trends and strategies in Visual Cash Focus forecasts and budgets

All editions of Visual Cash Focus have built in graphics for analyzing trends and strategies in budgets or forecasts.

Most graphs plot amounts for each period in the budget. The default names for each axis can be changed if required.

Items from the Profit and loss and Balance sheet can be plotted on the same graph e.g. accounts receivable from the balance sheet versus Total sales from the Profit and loss. Actuals can be included. If profit centers are in use, then you can choose which budget profit centers to include.

Share the data

Portability

There are a number of ways to facilitate model transfers between locations.

Zip/unzip models

Data can be compressed into a .zip file or retrieved from one.

This functionality adds convenience to model mobility with your budgets. You may want to save and retrieve budget models from alternative selected locations possibly for backup purposes or to send a model to someone electronically. Whatever the reason, for these occasions the Zip and Unzip functions are built in to simplify the task and optionally reduce the file size of the budget model which is handy for electronic transfer.

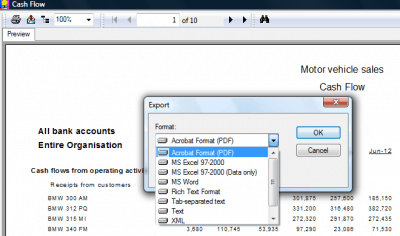

Export budgets

Reports can be printed or exported to Excel, Word and PDF. Budgets can be imported or exported from any system that has the ability to export / import data to an Excel or ASCII formatted file.

Conclusion

Comprehensive budget tool

Visual Cash Focus has all the components for comprehensive serious business budgeting and cash flow forecasting with rock solid data verification. From small business to large global enterprises different editions cater for the various needs. The software is PC based and does not rely on spreadsheet budgeting.

Return to Visual Cash Focus